South Africa – Cyprus Double Tax Treaty still opens the way for further development and new business opportunities between Cyprus and South Africa.

Cyprus is still considered as one of the preferred routes for both South Africa’s inward and outward investments. The key points of the Double Tax Treaty between South Africa and Cyprus relating to the dividends tax and the exchange of information:

South Africa – Cyprus Double Tax Treaty main provisions

- The withholding tax rate on dividends is 10% or 5% if at least 10% in the share capital of the company distributing the dividends.

- Withholding tax rate on interest 0%

- Withholding tax rate on royalties 0%

- Capital Gains Tax – Shares in a company owing movable or immovable property are disposed of without taxation in the country of the company holding the property. The taxing right remains with the country of the seller

- Residence -The definition of “resident in a Contracting State” is aligned with the 2010 OECD treaty model

- Exchange of information – aligned with the OECD Model. The level of information that is expected to be exchanged between the two States will be as much information as is foreseeably relevant

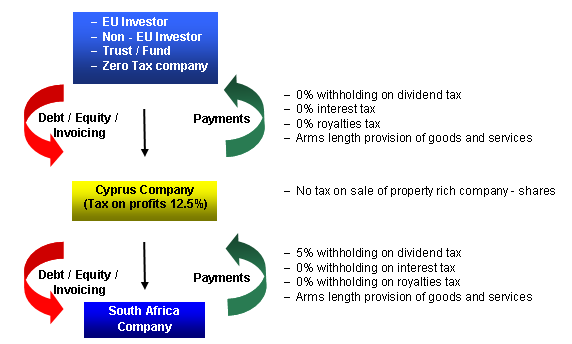

Structure – Investment in South Africa through Cyprus (considering South Africa – Cyprus Double Tax Treaty main provisions)

Notes:

- Profit from the sale of shares of property rich companies is tax-exempt in Cyprus provided property not situated in Cyprus

- Dividend interest and royalty payments from Cyprus to Non-Cyprus tax residents are not subject to tax in Cyprus. Dividend interest and royalty payments from Cyprus to Non-EU countries may be subject to low or 0% taxes in accordance with the double tax treaty of the Non-EU country with Cyprus. Dividend interest and royalty payments from Cyprus to EU countries are usually subject to 0% taxes in accordance with EU directives

- Dividend interest and royalty payments from South Africa to Cyprus are subject to low (5% on Dividends) or no (0% on interest and royalties) tax under Cyprus – South Africa double tax treaty new provisions

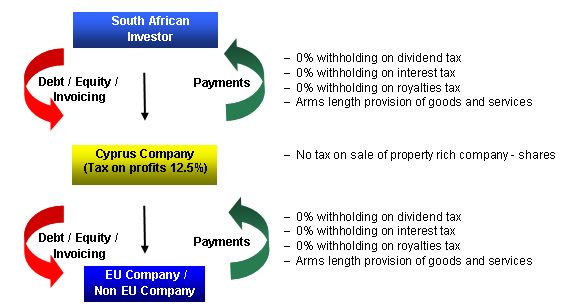

Structure – Investment from South Africa through Cyprus structure (considering amended South Africa – Cyprus Double Tax Treaty main provisions)

Notes:

- Profit from sale of shares of property rich companies is tax-exempt in Cyprus provided property not situated in Cyprus

- Dividend, interest and royalty payments from Cyprus to South Africa are not subject to a withholding tax in Cyprus. The Cyprus – South Africa double tax treaty amendments affect only dividend payments from South Africa as Cyprus does not impose a withholding tax on outbound dividends to non-Cyprus residents

- Dividend interest and royalty payments from EU / Non-EU countries to Cyprus are not subject to tax in Cyprus subject to easily met conditions. Dividend interest and royalty payments from Non-EU countries to Cyprus may be subject to low or 0% taxes in accordance with the double tax treaty of the Non-EU country with Cyprus. Dividend interest and royalty payments from EU countries to Cyprus are usually subject to 0% taxes in accordance with EU directives

The beneficial owner of income

Double tax treaty provisions including Cyprus – South Africa double tax treaty provisions will apply provided the recipient of income (dividends, interest, royalties, etc) is the beneficial owner of such income. The beneficial owner of the income is where recipient company’s powers may be exercised by its directors without the interference of its shareholders, sufficient economic substance is present, income is reported in the recipient’s bank account and financial statements, free deal with the inflow of funds by the recipient, the recipient has the ability to make decisions on its own and having fully-fledged offices and employ full time or part-time employees, Income received in a form of interest should be in the form of unrelated payment received and be at arm’s length with adequate margin returns

Conclusion

The double tax treaty between Cyprus and South Africa still remains competitive. The above dividend withholding tax rates are competitive amongst South Africa’s double taxation network. The double tax treaty between Cyprus and South Africa continues to provide for a zero withholding tax on interest and royalty. In addition, Cyprus retains the exclusive right to tax any disposal of shares in a company owning movable or immovable property in South Africa.

How Can We Help

Please contact us to share any questions you have about the above topic

Contact details

Tel. +357 22 340000

Email: [email protected]

The authors expressly disclaim all and any liability and responsibility to any person, entity, or corporation who acts or fails to act as a consequence of any reliance upon the whole or any part of the contents of this publication.

Accordingly, no person, entity, or corporation should act or rely upon any matter or information as contained or implied within this publication without first obtaining advice from an appropriately qualified professional person or firm of advisors, and ensuring that such advice specifically relates to their particular circumstances.