UBO Register in Cyprus

UBO register in Cyprus detailed information and related Examples

UBO register in Cyprus has been introduced by the European Union regulations resulting from the 5th European Directive (EU 2018/843, 30 May 2018) which harmonizes and strengthens the existing framework for preventing and combating money laundering and terrorist financing.

As a first phase, the UBO register in Cyprus will form a database, which government agencies can access upon request.

Specifically:

Date of start of the UBO register in Cyprus

UBO registration in Cyprus for Cypriot Companies and Other Legal Entities began on 16 March 2021

Who should be subject to UBO registration in Cyprus

In addition to the Ultimate Beneficial Owners (UBOs), officers of a Cyprus company (entity) including directors, managing directors, or secretary should also be registered.

Responsibility for UBO registration in Cyprus

Each Cyprus company – legal entity and each official should take measures to obtain and store sufficient, accurate, and up-to-date information on the beneficial shareholders of the Cyrus company – legal entity, including the following information:

Data to be entered in the UBO register in Cyprus

The data to be entered in the UBO register in Cyprus are as follows:

(a) the name and surname, date of birth, nationality, and residence address of each beneficial owner of the Cyprus company or entity;

(b) the type and extent of the ultimate ownership held directly or indirectly by each beneficial owner, including through a percentage of shares, voting rights, or through a significant influence of a person, or the type and extent of final control exercised directly or indirectly by each beneficial owner;

(c) the identification verification document number of the natural person, the type of document, and the country of issue of the document;

(d) the date on which a natural person became a beneficial owner, and

(e) the date on which changes were made to the data of the natural person who ceased to be a beneficial owner:

Cyprus UBO registration procedure for the identification of the Ultimate Beneficial Owner (UBO) of a Cypriot Company – Entity

The Cypriot company – legal entity shall send a notice to any individual who has reasonable grounds to consider him to be a beneficial owner.

The notice should be written, signed by an officer of the company or other legal entity, and sent to any individual for whom there are reasonable grounds to believe that he/she is the Ultimate Beneficial Owner (UBO), whom which it is required to;

(a) indicate whether or not he is a beneficial owner of the company – legal entity;

(b) if he/she is, provide in writing an update of the above relevant information;

The obligation of Ultimate Beneficial Owners (UBOs) to notify changes

Any natural person referred to as the beneficial owner of a Cyprus company or another legal entity is obliged to notify the changes to the Register of Ultimate Beneficial Owners (UBOs) of Cyprus.

Access to the UBO register in Cyprus of Cypriot Companies – Legal Entities

A Cyprus Company – a legal entity established before the beginning of the above-mentioned date of commencement of the UBO register in Cyprus, its officers must submit to the Registrar of Companies the above information regarding the beneficial owners of the Cypriot company – legal entity at the latest within six (6) months of the date of the commencement of the UBO register in Cyprus.

Access to the information held in the UBO register in Cyprus

The following persons will have access to the UBO register in Cyprus:

- Cyprus Anti-Corruption Unit (MOKAS), the Cyprus Tax Department, the Police, the Public Prosecutor’s Office, and the various supervisory authorities.

- Any member of the general public and the obliged entity shall have access only to:

- the name,

- the month and year of birth,

- citizenship and

- the country of residence of the beneficial owner,

- as well as the type and extent of the rights it holds,

If the Ultimate Beneficial Owner (UBO) of the Cyprus company – the legal entity is a minor, access is given subject to a written request. The Registrar of Companies of Cyprus may then request the following information:

- If the request is duly substantiated and supported by evidence

- If a court order has been issued allowing the disclosure of the information.

Trusts, institutions, foundations/other similar entities/listed companies

The following information should be submitted for trusts:

- Name

- Registry number (if any)

- Jurisdiction

No additional information about the Trust will need to be submitted.

For institutions/other similar arrangements/listed companies, the following information should be completed:

- Name

- Registry number (if any)

- Jurisdiction

- Business Address

Exemptions for disclosure of information

In exceptional cases, the Ultimate Beneficial Owner (UBO) of a Cyprus company – legal entity itself, provided that it has proven the consent of the Ultimate Beneficial Owner (UBO) or its guardian if the beneficial owner is otherwise legally incapacitated, may, upon written request to the Registrar of Companies of Cyprus, request an exemption from granting access to all or part of the information relating to the beneficial owner on the grounds that if access to such information is permitted,

- expose the beneficial owner to a disproportionate risk of deception, kidnapping, extortion, black-listing, harassment, violence, or intimidation;

- the beneficial owner is otherwise legally incapacitated.

The Registrar of Companies evaluates:

- if the request is duly substantiated and supported by evidence;

- the exceptional nature of the circumstances;

- if a court order has been issued allowing the disclosure of information:

Until the completion of the examination of a written request for exemption of access to information about an Ultimate Beneficial Owner (UBO) of a Cypriot company – legal entity, the Registrar of Companies of Cyprus does not allow access to information about that beneficial owner.

The exemptions do not apply to credit and financial institutions.

Type and extent of rights held by the Ultimate Beneficial Owner (UBO)

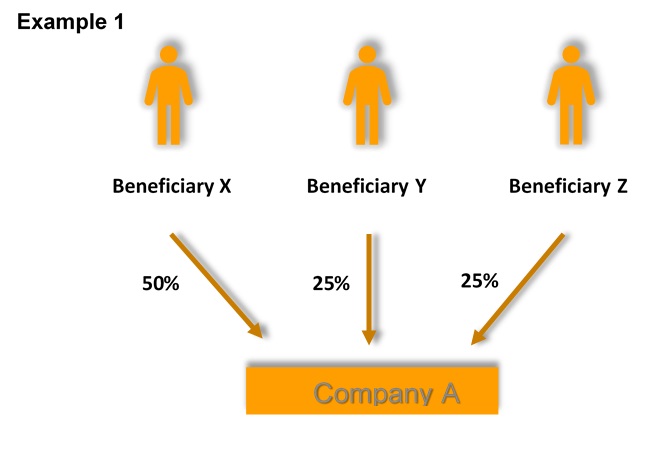

The beneficial owner may have direct, indirect, or a combination of direct and indirect ownership in a legal entity. According to the definition of the beneficial owner, the threshold of the ownership rate is set at 25% +1 share.

The nature and extent of the beneficial interest concerns all cases (Natural Person, Trust, Foundation, Other similar legal arrangements, and listed company).

The nature of beneficial ownership interest concerns direct or indirect or both.

- The direct shareholders of Company A are Ultimate Beneficiary X (25%), Ultimate Beneficiary Y (25%), and Ultimate Beneficiary Z (50%).

- Direct shareholders Z has 50% right to own and vote in Company A. Person Z is the only natural person who owns Company A through direct participation of 25% or more plus one share. As a result, Person Z is the beneficial owner of Company A.

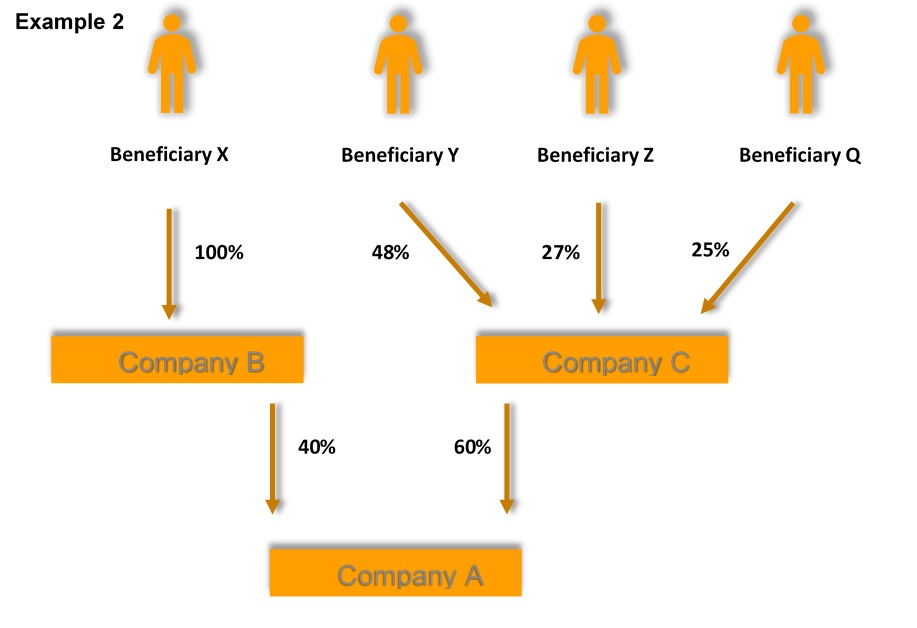

- The direct shareholders of Company A are Company B (40%) and Company C (60%).

- Company B holds the shares of Company A on behalf of Ultimate Beneficiary Owner X. Company B and Ultimate Beneficiary owner X may even have a trust settlement

- The direct shareholders of Company C are:

- Ultimate Beneficiary Owner Y (48%)

- Ultimate Beneficiary Owner Z (27%) And

- Ultimate Beneficiary Owner Q (25%)

- The Ultimate Beneficial Owner (UBO) X has 40% indirect ownership in Company A through Company B.

- The Ultimate Beneficial Owner Y has 28.80% (48% X 60%) indirect ownership in Company A through Company C.

- The Ultimate Beneficial Owner Z has 16.20% (27% X 60%) indirect ownership in Company A through Company C.

- The Ultimate Beneficial Owner Q has 15% (25% X 60%) indirect ownership in Company A through Company C.

- The Ultimate Beneficial Owner X (40%) and The Ultimate Beneficial Owner Y (28.8%) are the only natural persons who indirectly own Company A through a direct holding of 25% or more plus one share. Therefore, the Ultimate Beneficial Owner (UBO) X and the Ultimate Beneficial Owner (UBO) Y are the real beneficiaries of Company A

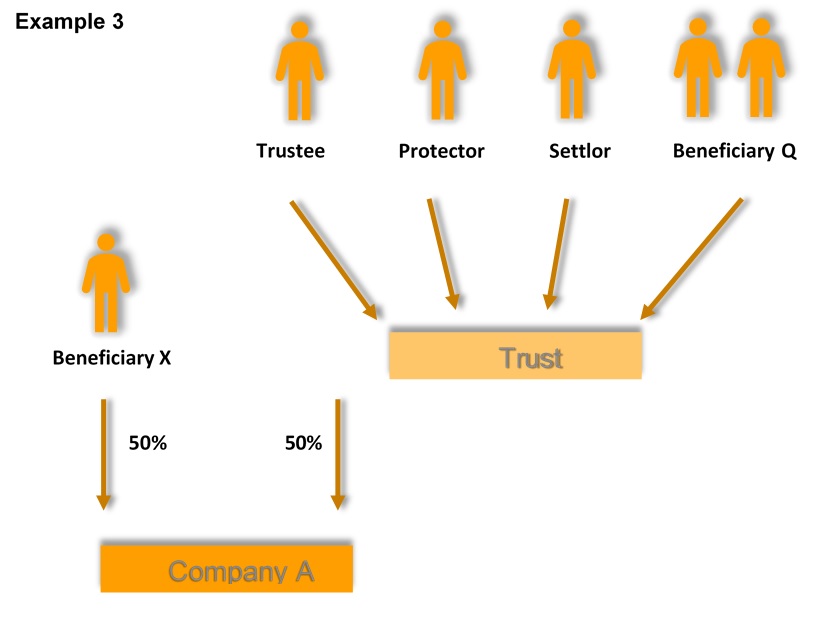

- The direct shareholders of Cyprus company A are Natural Person X (50%) and the trust (50%)

- The Ultimate Beneficial Owners (UBOs) of the Trust are the Administrator, the Protector, the Settlor, and the Beneficiaries

- Notwithstanding the above, the actual beneficiaries of Company A to be declared in the Register of Ultimate Beneficial Owners of Cyprus are only:

- The Ultimate Beneficial Owner X (50%)

- The trust (50%)

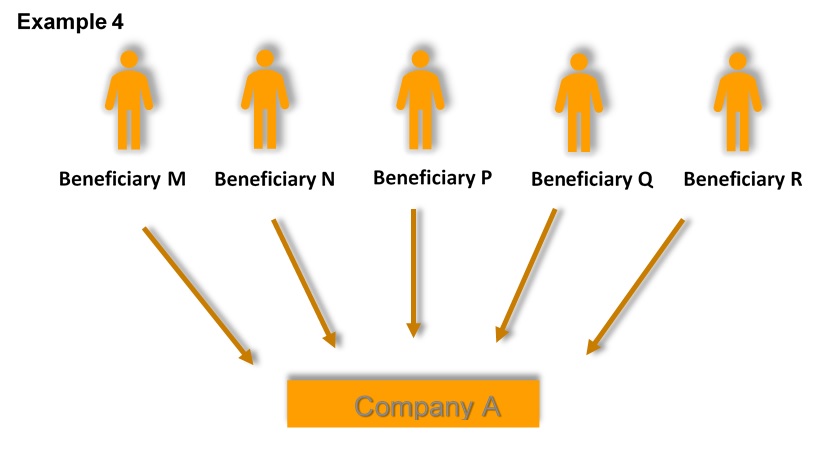

- The direct shareholders of Company A are the Ultimate Beneficial Owner M (20%), Ultimate Beneficial Owner N (20%), Ultimate Beneficial Owner P (20%), and Ultimate Beneficial Owner Q (20%), and Ultimate Beneficial Owner R (20%).

- No natural person owns Cyprus Company A with a holding equal to or greater than 25% plus one share.

- No natural person controls Cyprus Company A by other means.

- The ultimate beneficial owner of Company A is the natural person or natural persons holding the position or positions of Senior Managing Director. Company A keeps records of the actions taken to determine the beneficial owner.

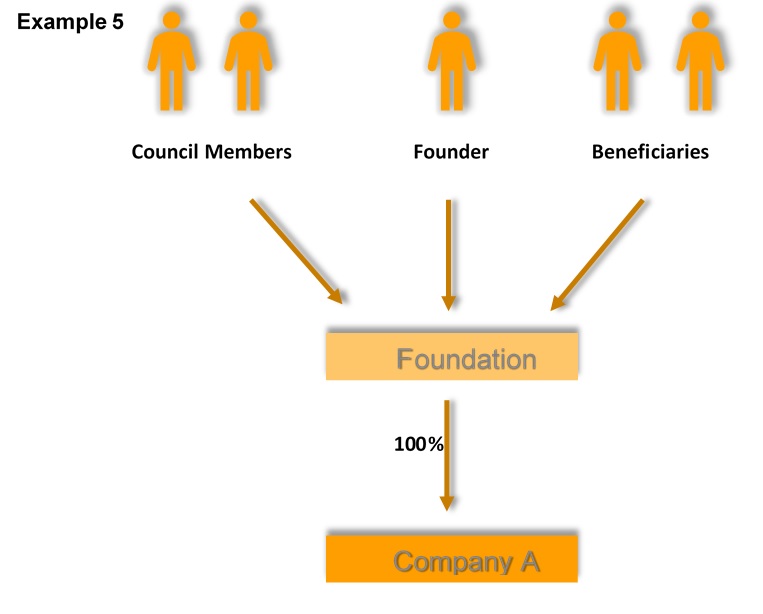

- The direct shareholder of Company A is the Foundation.

- The Foundation’s Ultimate Beneficial Owners (UBOs) are the Founder, the Beneficiaries and the Council of Members of the Foundation

- Despite the above, the Ultimate Beneficial Owner (UBO) of the Cyprus Company to be declared in the Register of Ultimate Beneficial Owners (UBOs) is only the Foundation.

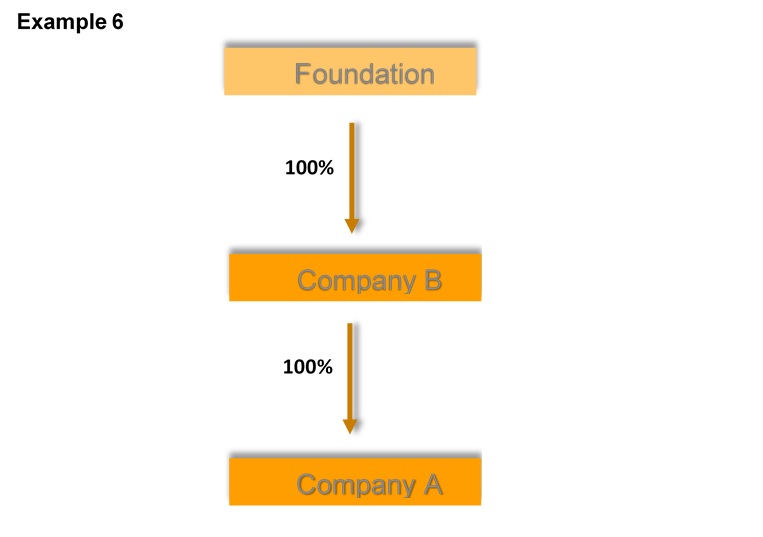

- The direct shareholder of Company A is Company B.

- The direct shareholder of Company B is a listed company on a stock exchange. The listed entity has an indirect ownership in Company A.

- The beneficial owner of the company to be declared in the Register of Ultimate Beneficial Owners is the listed company on the stock exchange.

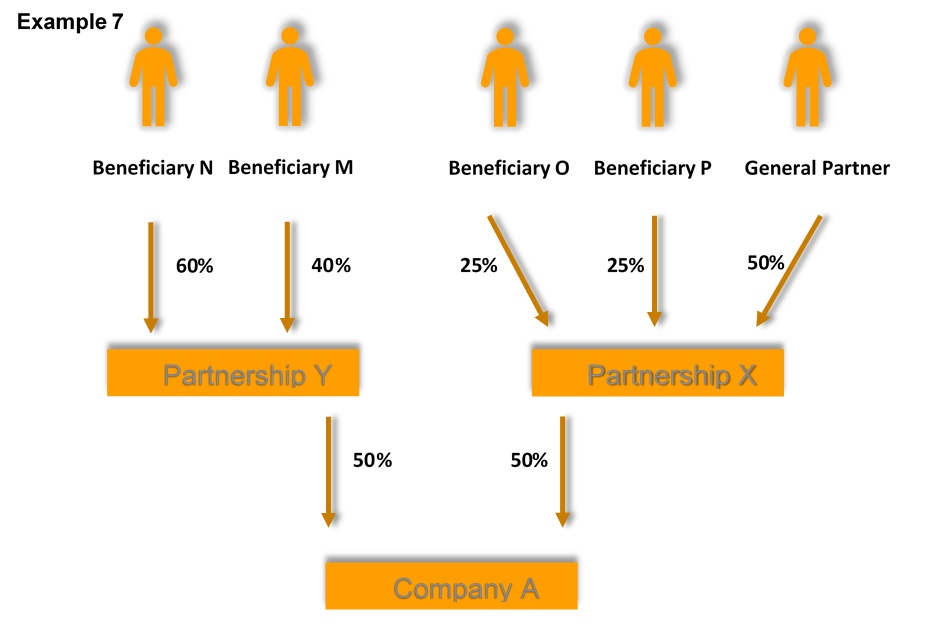

- The direct shareholders of Cyprus Company A are Partnership Y (50%) and Partnership X (50%).

- The partners of Partnership Y are:

- Ultimate Beneficiary Owner N (60%)

- Ultimate Beneficiary Owner M (40%)

- The partners of Partnership X are:

- Ultimate Beneficiary Owner O (25%)

- Ultimate Beneficiary Owner P (25%)

- Ultimate Beneficiary Owner General Partner (50%)

- Ultimate Beneficiary Owner N has 30% (60% x 50%) indirect ownership in Company A through the Y Partnership.

- The ultimate beneficiary M has 20% (40% x 50%) indirect ownership in Company A through Partnership Y.

- Ultimate beneficiary O and Ultimate beneficiary P have 12.50% (25% X 50%) indirect ownership respectively in Company A through Partnership X.

- The Ultimate beneficiary General Partner has 25% (50% x 50%) indirect ownership in Company A through Partnership X.

- The ultimate beneficiary N (30%) is the only natural person who indirectly owns Company A through a direct holding of 25% or more plus one share. Consequently, the Ultimate beneficiary N is the ultimate beneficial owner of Company A.

- If the General Partner has the power to represent Partnership X and the other 2 partners have given the mandate to vote and make decisions regarding the investment of the Partnership in Company A, then the General Partner must also be declared as the beneficial owner of Company A.

Our views on the UBO register in Cyprus

- Identifying the Ultimate Beneficial Owner of Cypriot registered companies at this point in time can be difficult considering that several Cyprus companies have built chain structures linked to other jurisdictions.

- The UBO register in Cyprus, with different levels and ways of access, will be available much later

- It is appreciated and stressed that companies in Cyprus that can demonstrate a substantial reason for staying in Cyprus as well as maintaining offices with staff in Cyprus will have no particular reason to be concerned, therefore Cypriot companies are encouraged to take into account new developments by acting proactively.

How can we help

Please get in touch with us to share any questions you have about the above topic

Contact

Tel. No.:+357 22 340000

Email: [email protected]

Important note: The author expressly disclaims any liability towards any person, entity or company acting or not acting as a result of any reliance on all or part of the content of this publication.

Therefore, no person, entity, or company should act or rely on any matter or information as contained or implied in this publication without first receiving advice from a properly qualified professional or consulting firm.

Top of Form